How many times has it happened that you wanted to buy something but couldn’t because of your budget?

The same situation applies to home renovation. Many homeowners wish to renovate their homes when they are selling or buying a new one.

However, it can take some time to sell a property which means that you must wait to buy a new one.

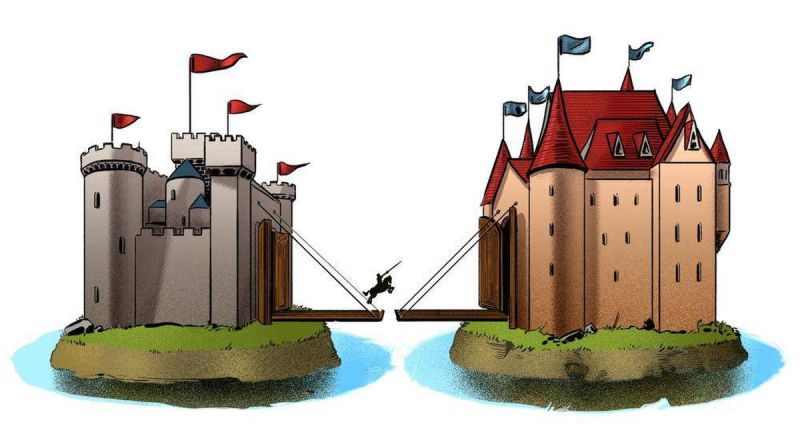

And that’s where bridging loans comes in handy. It is a type of loan that allows a homeowner to buy a new home and acquire more time to sell their existing property. To buy a new home you have to check your eligibility, and you can check it on usda map.

Using a bridging loan, a homeowner can borrow up to 80% of the peak debt, i.e. the purchase price of new property and current mortgage. After all, whether you are selling your home or purchasing one, you would like to make some modifications and renovate your home as well.

Renovation helps to sell the property at a higher price, and it is also required to make sure that the new home is to your satisfaction.

Many lenders consider using the bridging finance option to purchase and renovate their property. The loan serves as a right product for refurbishment as bridging loan funds can be acquired fast if you are eligible.

Find out more about bridging loans click here

How to Qualify for Bridging Loan To Renovate the Property?

You can apply for this type of loan for the acquisition of property. But keep in mind that if you have an individual requirement for renovation, getting the bridging loan approved won’t be possible. To qualify for this type of loan, you need to fulfil these terms.

Equity- Even though there is no hard and fast rule for equity, but it will be easier to get the loan if you have more than 50% of equity so that the loan amount can be worthwhile.

Standard Serviceability Requirements-

The borrower needs to provide evidence of the current income, expenses, employment status, and other supporting documents that a person generally needs to get a loan.

Term of No More Than 6 Months for Purchase of Existing Property-

Using the bridging loan, a person can acquire the gap between the amount required for purchase and the amount they will get after selling the existing property. However, the term for that finance must not be more than six months. Under some conditions, an extension can also be provided.

If you want to buy a new property with the loan, then the term for the loan can be 12 months.

Unconditional Sale on Existing Property-

The prerequisite states that you must exchange the contract for the existing property before you ask a lender for the loan.

If you get in touch with a lender service or finance company or a bank, they can provide an assessment form so that you can find out if you can qualify for the loan. With the amount you get, it will be easy for you to set aside enough money that can be used in home renovations.